Question about inflation

Published by Panda on Wednesday, February 20, 2008 at 12:40 PMI'm not an economist, but I do like reading blogs from economists. One of the things that I've picked up on from some posts has been the idea that China is not a source of inflation, when you look at the data. Here's a clip from the WSJ:

“Imports constitute around 15% of U.S. GDP and around 13% of that comes from China,” the authors write in an article in the latest issue of China & World Economy, an English-language journal published by the Chinese Academy for Social Sciences. On their back-of-the-envelope calculation, that means a 1 percentage point increase in China’s inflation rate should lead to an increase in U.S. inflation of 0.02 to 0.03 percentage points. Yet their comparison of historical price trends in China with those in both the U.S. and Japan found the actual effect was even smaller.And here's one from Paul Krugman:

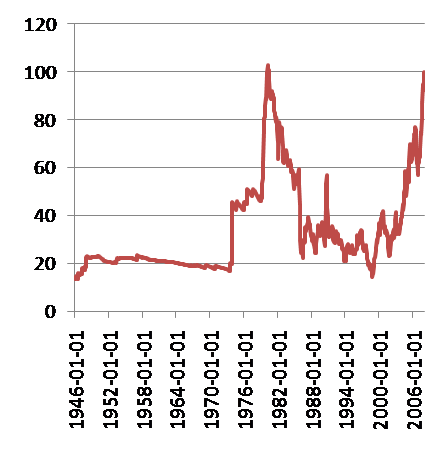

In fact, overall, the US spends a little more than 2 percent of GDP on Chinese goods. That’s dramatically more than in the past. But it suggests that if Chinese prices rise 10%, the overall cost of living here would rise by less than a quarter of a percent. Every little bit hurts, but this isn’t as big a deal as a casual reading of this article might lead you to think.Fine, so if the prices of Chinese imports go up, the total effect in the US won't be that big. But, what about the effect of China on the price of commodity inputs? Here's a graph of real oil prices in Feb. 2008 dollars.

Now, what I've been reading is that the run-up in oil prices can be partially attributed to Fed Monetary policy. But the other thing that could be driving it is huge demand growth coming from China, and to a lesser extent India. I have no way of telling which of these two factors is playing a larger role. However, let's say that factor #2 is in fact big. Wouldn't that subsequently mean that China is playing a significant role in global inflation? Someone enlighten me.

Now, what I've been reading is that the run-up in oil prices can be partially attributed to Fed Monetary policy. But the other thing that could be driving it is huge demand growth coming from China, and to a lesser extent India. I have no way of telling which of these two factors is playing a larger role. However, let's say that factor #2 is in fact big. Wouldn't that subsequently mean that China is playing a significant role in global inflation? Someone enlighten me.

Labels: economics

1 comments:

Subscribe to:

Post Comments (Atom)

I don't know if this is a chicken/egg thing, but here's another aspect to consider -- oil prices are still tied to the US Dollar, which, I think, means that given the falling dollar, oil producers have had to raise prices to preserve their income in real terms.

Sure, I think increased demand from China has some effect on the price of oil, but it's hard to say with any certainty, since the market for oil isn't a true supply/demand market.

It's easier to point to the fall of the dollar to the increase in the price of oil.

That said, I have no idea (and shouldn't really claim that I have any idea as to why oil prices are rising) why other commodity prices are increasing.

But to address the specific example in your question, I would agree that a rise in commodity inputs itself contributes to inflation, but I'm not sure whether China plays a major role in that.