More on the US not being in a recession

Published by Panda on Wednesday, April 30, 2008 at 10:16 AM

Snippet from Paul Krugman on recessions:

So, GDP was up slightly in the first quarter. Does that mean that we’re not in a recession? The correct answer is, who cares?

The NBER Business Cycle Dating Committee defines a recession as

a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

Broadly speaking, that means that the economy is only considered to be in a recession when everything is going down. Historically, that hasn’t been a problem, since most recessions have been “V-shaped”: everything plunges, and then everything springs back, so there isn’t much ambiguity about whether the economy is worsening or not.

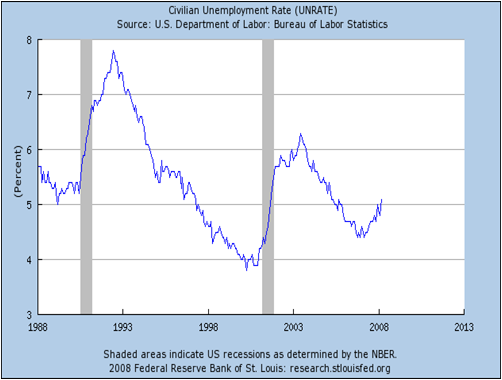

But since the mid-1980s we have been having “U-shaped” recessions in which the upturn is slow and weak. As a result, things that matter to a lot of people — like the unemployment rate, shown above — keep getting worse long after the official recession period, indicated by the shaded areas. Officially, the recession of 1990-91 was long over by the 1992 election, but people were still very worried about the economy, stupid. The 2001 recession officially ended in November of that year, but the job situation kept getting worse until the middle of 2003.

The point is that the official definition of recession has become delinked from peoples’ actual experience. Right now, we’re in an economy with deteriorating employment and incomes, collapsing home prices, and business retrenchment. Is it also an economy in recession? Who cares?

Labels: economics

Snippet from Paul Krugman on recessions:

So, GDP was up slightly in the first quarter. Does that mean that we’re not in a recession? The correct answer is, who cares?

The NBER Business Cycle Dating Committee defines a recession as

a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

Broadly speaking, that means that the economy is only considered to be in a recession when everything is going down. Historically, that hasn’t been a problem, since most recessions have been “V-shaped”: everything plunges, and then everything springs back, so there isn’t much ambiguity about whether the economy is worsening or not.

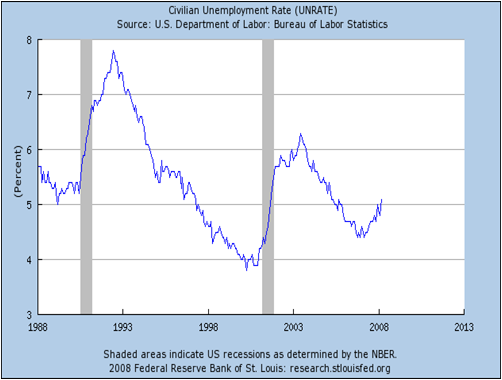

But since the mid-1980s we have been having “U-shaped” recessions in which the upturn is slow and weak. As a result, things that matter to a lot of people — like the unemployment rate, shown above — keep getting worse long after the official recession period, indicated by the shaded areas. Officially, the recession of 1990-91 was long over by the 1992 election, but people were still very worried about the economy, stupid. The 2001 recession officially ended in November of that year, but the job situation kept getting worse until the middle of 2003.

The point is that the official definition of recession has become delinked from peoples’ actual experience. Right now, we’re in an economy with deteriorating employment and incomes, collapsing home prices, and business retrenchment. Is it also an economy in recession? Who cares?