Krugman on Oil bubbles

Published by Panda on Thursday, May 15, 2008 at 7:44 AMFrom Paul Krugman:

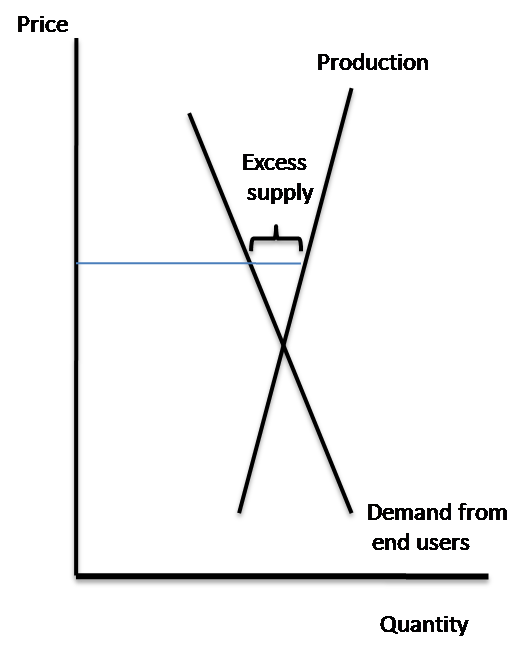

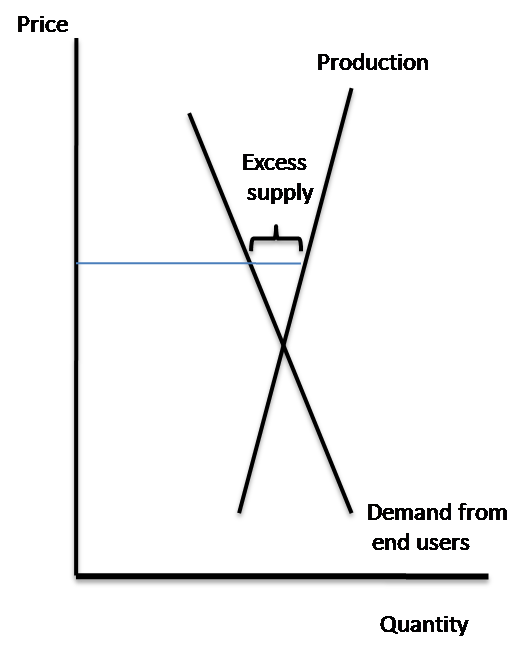

One of the things I find puzzling about the whole oil market discussion is how complicated people seem to make it. They get all wrapped up in stuff about forward markets, hedge funds, etc., and lose sight of the fundamental fact that there are only two things you can do with the world’s oil production: consume it, or store it.If the price is above the level at which the demand from end-users is equal to production, there’s an excess supply — and that supply has to be going into inventories. End of story. If oil isn’t building up in inventories, there can’t be a bubble in the spot price.

Now it’s true that oil supply responds very little to price, and that empirical estimates of the short-run price elasticity of demand, like this one, suggest that it’s low — say -.06. But even so, the math of a sustained, large bubble quickly becomes daunting. Say the demand elasticity is -.06, and that you believe that the current price is 40% above the level at which end-use demand equals supply. Then you have to believe that 2 million barrels a day is disappearing into secret hoards somewhere — secret, because it’s not showing up in the OECD inventory data. That’s a lot of oil. And bear in mind that people have been claiming that there’s an oil bubble for years

So my challenge to people who say there’s an oil bubble is this: let’s get physical. Tell me where you think the excess supply of crude is going.

Labels: economics , financial markets

One of the things I find puzzling about the whole oil market discussion is how complicated people seem to make it. They get all wrapped up in stuff about forward markets, hedge funds, etc., and lose sight of the fundamental fact that there are only two things you can do with the world’s oil production: consume it, or store it.If the price is above the level at which the demand from end-users is equal to production, there’s an excess supply — and that supply has to be going into inventories. End of story. If oil isn’t building up in inventories, there can’t be a bubble in the spot price.

Now it’s true that oil supply responds very little to price, and that empirical estimates of the short-run price elasticity of demand, like this one, suggest that it’s low — say -.06. But even so, the math of a sustained, large bubble quickly becomes daunting. Say the demand elasticity is -.06, and that you believe that the current price is 40% above the level at which end-use demand equals supply. Then you have to believe that 2 million barrels a day is disappearing into secret hoards somewhere — secret, because it’s not showing up in the OECD inventory data. That’s a lot of oil. And bear in mind that people have been claiming that there’s an oil bubble for years

So my challenge to people who say there’s an oil bubble is this: let’s get physical. Tell me where you think the excess supply of crude is going.