This is a cut-and-paste of an Op-Ed I found pasted at the Big Picture. It's sort of at the cross-section of economics and politics, with more emphasis on the economics. For those of you that whip out your "nerd-alert!" signs whenever you hear the word "inflation" or "%," this may not be for you, although I would still encourage you to read. Italics added by me:

This is a cut-and-paste of an Op-Ed I found pasted at the Big Picture. It's sort of at the cross-section of economics and politics, with more emphasis on the economics. For those of you that whip out your "nerd-alert!" signs whenever you hear the word "inflation" or "%," this may not be for you, although I would still encourage you to read. Italics added by me:

Pricing in a Bush Presidency?

Wall Street Journal, July 9th 2000Stocks sold off again today as the markets is pricing in the likely impact of a George W. Bush presidency.

Since Bush has emerged as the polling leader in March, stocks have been hit hard. The NASDAQ has fallen 37%, while the S&P500 and the Dow are both down 20%, placing equities squarely in bear market territory.

Various Wall Street strategists have expressed concern regarding how a new set of Bush monetary and overseas policies could impact equities.

"My biggest concern is that the promised Bush tax cuts will be in extremely expensive. That would create huge deficits and be extremely inflationary" said Peter Leslie, a trader on the CBOT floor." Governor Bush has promised to reduce captial gains and dividend taxes, and lower the marginal rates on the nation's biggest earners. He has not explained how these tax cuts will be funded.

Maverick Capital fund manager Henry Carlyle is more concerned with government spending than Tax cuts. The Dallas resident stated "I have followed Governor Bush in Texas, and fiscal discipline is not his strong suit." Cabot expects a big increase in federal spending and budget deficits that will have ramifications for both inflation and an interest rates.

Vanguard chief John Bogle is more concerned with a lax regulatory environment: "A return to the sort of crony capitalism that we've seen in the past would wreak havoc with investor confidence. We need a strong SEC to make sure companies are transparent, and report their accounting fully and fairly. We should not throw the individual investor to a wild and woolly free market that is totally lacking in supervision." The Vanguard chief has long been a proponent of a strong regulatory environment for the protection of individual investors. "I do not see that sort of regime under a President Bush."

Robert Rubin, the Treasury Secretary under Presdient Clinton who retired last year to join the Board of Citigroup, focused on the Federal Reserve. "The next president needs to make sure that the Federal Reserve fulfills its obligations as bank supervisor. I am concerned that Governor Bush, as President, would move away from strict regulation of markets for ideological reasons." Rubin, a Democrat, warned of negative repercussions for the housing and financial sectors. "[Since joining Citigroup], I have been looking into the issue of derivatives. This is another area that requires close scrutiny from both the Treasury Department and the Federal Reserve. I see Bush lacking expertise in this crucial area."

Goldman Sachs chief investment strategist Robert Hormat, was even blunter in his assessment of a Bush Presidency: "I am looking for a market crash as a reaction to the election of George W. Bush. Investors should brace themselves for losses of 50% or more -- and even worse in the Tech sector -- should he be elected."

Legendary legendary oil trader T. Boone Pickens is more optimistic. "We should expect several military conflicts in the Middle East under President Bush[!!!], and while this may not be great for the economy it will be terrific for my energy holdings." If Bush gets elected, Pickens plans on opening a new oil based hedge fund, and is forecasting 100% increase in the price of oil to $40. "I'm an Oil, George is an Oil man, and his VP Dick Cheney is an Oil man. I expect energy returns to significantly outperform equity markets over the next eight years" he said.

For those of you that noticed, this article was written in July of 2000 and pretty much everything that I highlighted - which was almost the entire article - has actually came true. We now have huge deficits, rampant inflation, "crony capitalism" paired with a weak SEC, excessive deregulation which may have lead to our current economic crisis, as well as military conflicts in the Middle East. Oh yeah, and as for T. Boone Pickens's Oil fund, if he was expecting a 100% increase to get him to $40, then...

Labels: economics , financial markets , politics

From Paul Krugman:

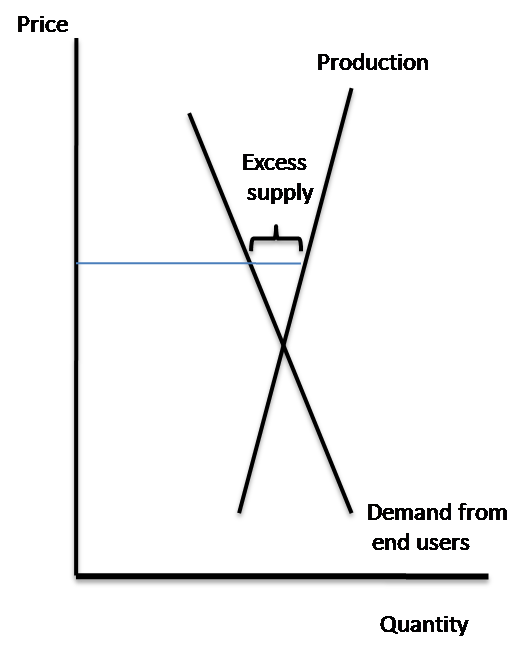

One of the things I find puzzling about the whole oil market discussion is how complicated people seem to make it. They get all wrapped up in stuff about forward markets, hedge funds, etc., and lose sight of the fundamental fact that there are only two things you can do with the world’s oil production: consume it, or store it.If the price is above the level at which the demand from end-users is equal to production, there’s an excess supply — and that supply has to be going into inventories. End of story. If oil isn’t building up in inventories, there can’t be a bubble in the spot price.

Now it’s true that oil supply responds very little to price, and that empirical estimates of the short-run price elasticity of demand, like this one, suggest that it’s low — say -.06. But even so, the math of a sustained, large bubble quickly becomes daunting. Say the demand elasticity is -.06, and that you believe that the current price is 40% above the level at which end-use demand equals supply. Then you have to believe that 2 million barrels a day is disappearing into secret hoards somewhere — secret, because it’s not showing up in the OECD inventory data. That’s a lot of oil. And bear in mind that people have been claiming that there’s an oil bubble for years

So my challenge to people who say there’s an oil bubble is this: let’s get physical. Tell me where you think the excess supply of crude is going.

Labels: economics , financial markets

Compelling point about moral hazard, courtesy of Credit Slips:

While moral hazard concerns are a real issue for any government aid to borrowers or lenders, its worthwhile remembering a major exception to moral hazard--third-party costs. As Larry Summers summarizes: When the fire department rescues people who start fires by smoking in bed, it creates a moral hazard for in-bed smokers. But no one gets exercised about moral hazard, in part because we know that fires can spread and burn down neighbors' apartments in "contagion" fires and that the in-bed smokers won't take care to insure their neighbors. That's what we're seeing in foreclosure crisis--mounting third-party costs to neighbors and local government. If the municipal government goes bankrupt [for readers in California, think about Vallejo], it affects everyone in the community--indeed, those who had to relocate because of foreclosure escape this consequence. Foreclosure is a real problem for everyone, not just those who get kicked out of their homes or whose investment portfolios take a hit.The point they're making is aimed mostly at people that think those who purchased homes they couldn't afford should just live with the consequences of their stupidity. However, it could be extended to those that think that the Fed did the wrong thing in "bailing out" Bear Stearns. The people that got bailed out at Bear Stearns weren't the employees or the shareholders. In fact, pretty much all of those guys got screwed. The people that got bailed out were Bear's counterparties, who didn't have much to do with Bear's business beyond funding it.

Labels: financial markets

The following graph plots actual earnings (red) versus the forecasts of equity analysts (black).

Wow. On the whole, these guys are worthless.

Labels: financial markets

Putting the sale of BSC in perspective

4 comments Published by Panda on Monday, March 17, 2008 at 11:34 AMJPM's cost for acquiring BSC:

$236-$270MNNY Yankees' cost for acquiring A-rod:

$275MN, with an additional $30MN if he breaks the home run recordYeah. BSC < A-Rod.

**************************

Update:

I mixed up the BNs and MNs signs, which are now fixed. That being said, this is still crazy.

Labels: economics , financial markets